Quarterly Wine Market Report, Q3 2023

*Accuracy of data is not guaranteed. This is purely a writing exercise

The Overview

Q3 came, it went, and it left some waves. The stock market faced turbulence, with major indices like the S&P 500 and Dow Jones Industrial Average experiencing notable declines. Bitcoin and crude oil, however, stood out with impressive gains. If you’re seeking stability amidst the financial chaos, fine wine continues to be a safe haven, offering resilience and growth.

By the Numbers

11.9% — The returns of Domaine de la Romanée-Conti’s Romanée-Conti Grand Cru 2017, the best return of any Burgundy

32 % — The rise of the California 50 Index year-to-date, largely spearheaded by Screaming Eagle

60% — The percentage of investors planning to increase their investments in fine wine in Q4 2023, according to Vin-X Market Analysis

Fine Wine Performance in Q3

The fine wine market continued to show resilience in Q3 2023, despite broader economic uncertainties. This sector saw growth in value between 1% and 4%. The segment’s strength can be attributed to the high quality of recent vintages and sustained demand from collectors and investors. For instance, wines from Bordeaux, such as Château Lafite Rothschild, experienced increased interest given positive reviews from both Suckling and The Wine Advocate.

Additionally, Champagne on the whole maintained steady trade volumes despite some labels experiencing price fluctuations. Dom Pérignon 2013, for example, was the most traded wine by volume. It had a robust market presence despite a slight dip in market price. The consistent demand for premium Champagne, especially with the festive season approaching, underscores the market’s resilience and the continued preference for the legacy of this particular sparkling wine.

Challenges in Burgundy and Other Regions

The weather was not kind to Burgundy this quarter. Late spring frosts and summer hailstorms affected grape yields, but despite these difficulties, the surviving grapes showed promising quality. A low-yield but high-quality vintage might be on the horizon. However, even though the resilience and skill of Burgundies winemakers in the face of such adverse conditions was on full display, the overall market saw a cautious approach from buyers, leading to more selective purchasing. Ever the bulwark, prices for top-tier labels, like Domaine de la Romanée-Conti, remained stable.

Other regions, such as Napa Valley and Tuscany, also contended with weather extremes. Napa Valley experienced unlikely heavy rains early in the quarter, followed by a hot and dry summer, which impacted the timing and quality of the harvest. Tuscany, too, faced an abnormally arid and hot season, which stressed the vines, resulting in lower yields but highly concentrated grapes. Perhaps for the better, these conditions led to a focus on quality over quantity.

Market Dynamics and Future Outlook

The fine wine market displayed resilience in the wake of broader economic troubles and cautious optimism looking into Q4. The Liv-ex 1000 Index showed signs of recovery, indicating a potential stabilization for the coming months. This recovery was partly driven by increased trade in Bordeaux. Though it did not experience the highest returns this quarter, it regained its position as a dominant force in the secondary market due to its volume. High-quality releases and a resurgence in interest from collectors and investors bolstered Bordeaux’s trade share.

It was Barolo, however, that rushed into first place in terms of returns this quarter. Though one could certainly call Barolo a name-brand region, when it comes to recognition in the world-wide pantheon, it still sits behind the French Trio. This jump in returns could be an indication that a substantial part of the market is interested in its value proposition. Though not cheap by most standards, when compared to its Burgundian counterparts, it offers a phenomenal bang for your buck. Bordeaux and Champagne’s performance pitted against Barolo’s returns might suggest there are two schools of thought in the market. The first being a line of thinking we’ve all come to expect: Investors trust name-brand regions; when times are uncertain, legacy matters. The other being a value-oriented philosophy.

Looking ahead, the fine wine market is expected to see continued interest in premium segments, particularly as the festive season approaches and people look for corks that go pop. Additionally, continued technological advancements in vineyard management and sustainable practices are likely to play a crucial role in maintaining the quality and appeal of fine wines. Trends are pushing more and more towards the marketability of organic, and even biodynamic, farming. As the market adapts to evolving economic conditions and consumer preferences, regions that can innovate and uphold high farming standards are expected to perform well.

Returns of Major Wine Regions in Q3

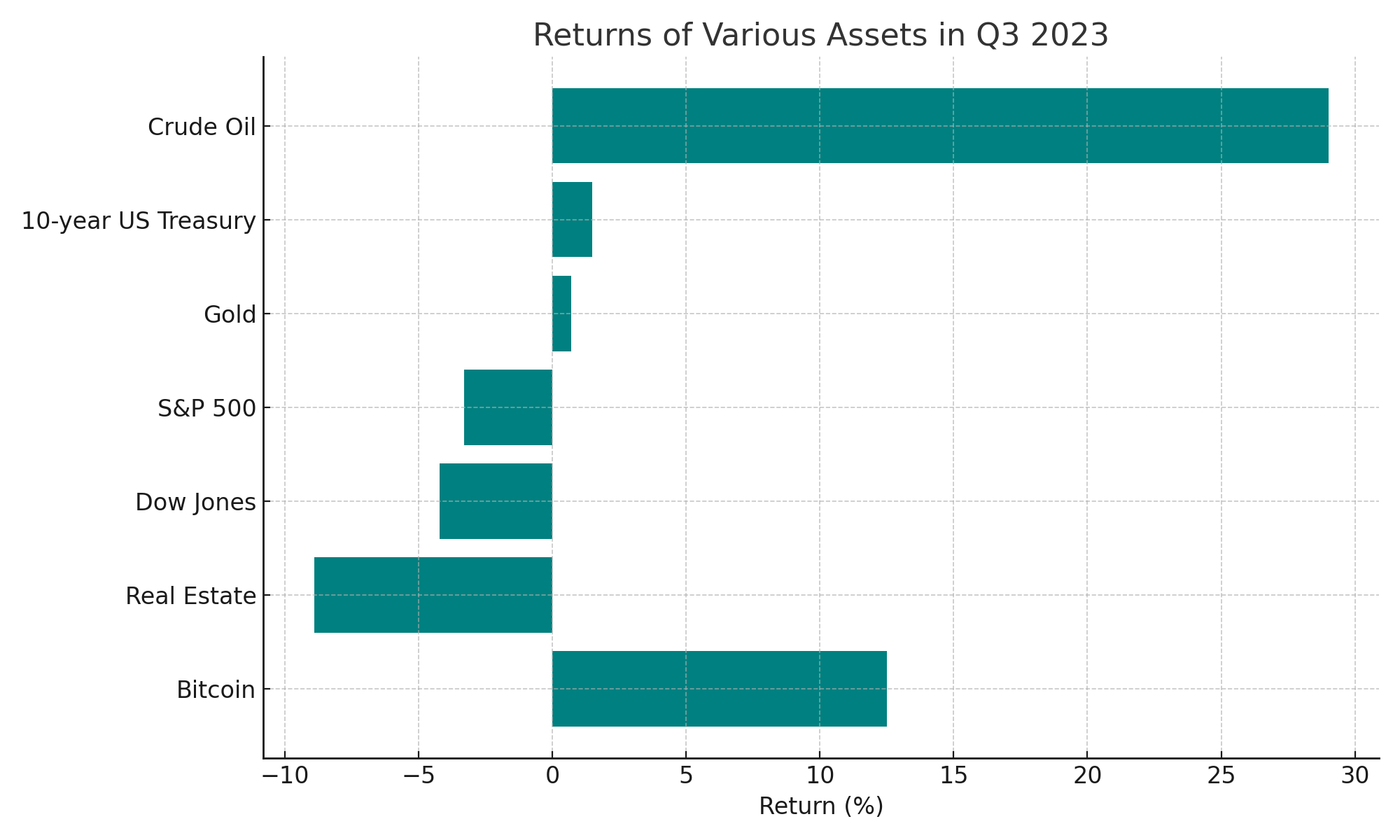

Financial Markets in Q3

The third quarter saw significant movements across various asset classes:

• Bitcoin surged by 12.5%, showcasing its potential as a hedge against traditional financial instability.

• Real Estate struggled, with a notable decline of 8.9% due to rising interest rates.

• Dow Jones and S&P 500 both faced declines of 4.2% and 3.3%, respectively, reflecting investor concerns over economic conditions.

• Gold remained a steady performer with a modest increase of 0.7%.

• 10-year US Treasury yields rose by 1.5%, influenced by the Federal Reserve’s interest rate policies.

• Crude Oil experienced a significant increase of 29%, driven by supply constraints and geopolitical tensions.

Investing Outlook for Q4

As we move into the fourth quarter of 2023, the wine market presents a grab bag of challenges and opportunities. The overarching theme is one of cautious optimism. Chin up, as well as guard up.

Resilience Amid Economic Fluctuations

As we’ve noted, despite global economic uncertainties, the fine wine market has shown resilience, particularly in the premium segment. Regions such as Bordeaux and Champagne have maintained stable trading levels, relying heavily on legacy, with Bordeaux experiencing a resurgence in trade share. Barolo punches slightly above its weight class, outpacing the French. Investors can expect continued interest in these regions, particularly as fall rolls around and consumers are in the market food-friendly wine for the holidays.

Impact of Low Global Production

2023 sets a record for global production lows, the lowest since 1961. This will likely to bode well for investments in the top-tier of high-quality wines. The scarcity could benefit holdings from regions like Burgundy and Bordeaux, where lower yields often correlate with higher market value due to limited supply and consistent demand.

Regional Variations and Opportunities

The Rhone Valley is expected to see strong harvests, presenting opportunities for investors to acquire high-quality wines at potentially lower prices. Châteauneuf-du-Pape is one to keep on your radar. Conversely, regions like Bordeaux, which are dealing with significant mildew damage and reduced yields, may see price increases due to limited availability. Strategic investments in these areas could yield substantial returns as market dynamics shift.

Market Sentiment and Collector Interest

All in all, with a significant percentage of investors feeling bullish about the market going into Q4, the overall sentiment is good. High-profile auctions and record-breaking sales of rare wines continue to underscore the investment potential of fine wine, making it a compelling alternative asset class for portfolio diversification.

In summary, Q4 2023 presents a landscape where savvy selection and strategic timing will be key for investors. Holding regions with stable or rising trade shares and keeping an eye on regions with projected strong harvests will be key. Capitalizing on the scarcity of high-quality wines due to low global production can provide robust opportunities for growth and returns.